Sign up to our newsletter Back to news

Five tracks for the next ten years: Could this be India’s decade?

As the nation swam through the challenges actuated by the pandemic, its economy faced a fair share of learnings along the way.

The year 2020 saw an extraordinary disruption to lives and livelihoods all across the world, and India was no exception. Although the Indian economy is based on strong partnerships and a robust democracy, several critical risks remain. The pandemic and the subsequent lockdowns in 2020 have exposed the fragility of India’s job market when India’s growth in unemployment has already been one of the top concerns for a few years now. Additionally, prominent issues like dwindling consumption demand, lack of financial inclusion, poor skill levels, rising fuel prices and poor labour-force participation among women are some barriers in the Indian growth story.

As the nation swam through the challenges actuated by the pandemic, its economy faced a fair share of learnings along the way. Owing to the immense resilience of the industries and their ability to innovate and adjust to the new normal, many believe that the Indian economy is back on its path to recovery and will soon emerge as the fastest-growing major economy in the world. This essay discusses five interconnected paths that could define India’s economic prominence in this ‘decade of action.’

I. ‘Pharmacy of the world’

Flashback to 2001 when Africa was facing a major health crisis and Sub-Saharan Africa alone had around 23 million HIV-positive patients. The price of patented drugs supplied by western drug companies was as much as US$ 10,000 per patient annually — which was well out of the reach of the average patient — when Cipla entered the game with a generic version of the same drug at one-twenty-fifth of the price. This was followed by several other Indian drug companies who harnessed the scale economies, which saved hundreds of thousands of lives globally. This led to an eighteen-fold increase in the number of AIDS patients being treated in that decade.

"India contributes the second-largest share of the pharmaceutical and biotech workforce on the planet."

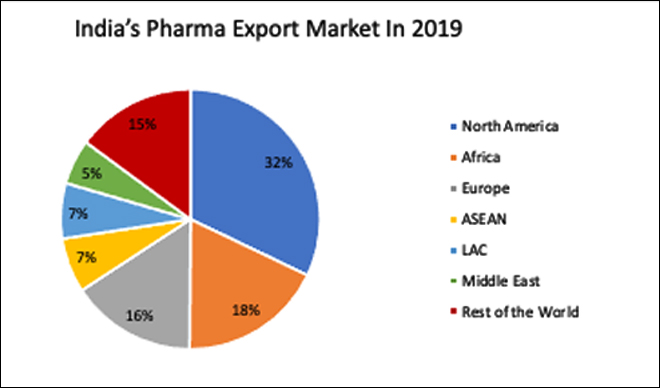

The Indian pharmaceutical sector exports drugs to more than 200 countries while supplying over 62 percent of the global demand for various vaccines. India also manufactures 40 percent of the generic demand for the US and 25 percent of all medicines for the UK, making the country the largest provider of generic medicines globally. India likewise contributes the second-largest share of the pharmaceutical and biotech workforce on the planet. With a growth of 9.8 percent year-over-year from 2018, the Indian pharmaceutical sector stands at a turnover of US$ 20.03 billion in 2019; it is only fair to say that India is the ‘pharmacy of the world.’

Source: Pharmaceutical Export Promotion Council (Pharmexcil), 2019

Since the COVID-19 pandemic began, the country has been at the vanguard of vaccine diplomacy. India supplied Hydroxychloroquine to several countries and also consistently supported the temporary suspension of COVID-19 vaccine intellectual property rights so that generic manufacturing of any new vaccine becomes much faster. It is estimated that India will produce 3.5 billion doses of coronavirus vaccines in 2021. While India only requires around a billion doses for its population, it aims to provide 20 million doses to neighbouring countries like Nepal, Bangladesh, Sri Lanka, Afghanistan, Seychelles, and Mauritius under its grant assistance programme. Other countries that have also signed government-to-government vaccine pacts with India are scheduled to receive the vaccines soon. Hence, there is no doubt that India will set the rules of COVID diplomacy and be the main party to the major vaccination drives across the globe, in the next few years.

II. Sustainable Development and Ease-of-Doing Business

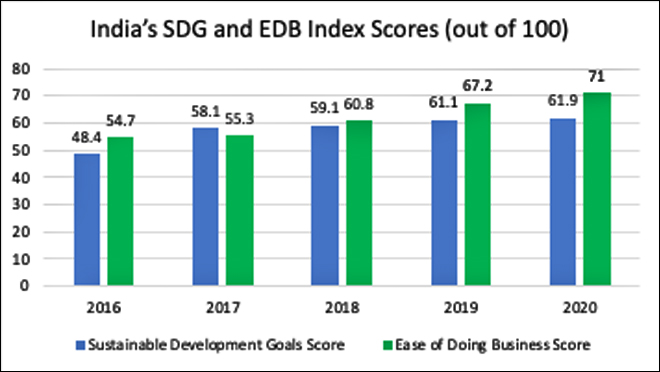

India’s progress towards the achievement of the UN Sustainable Development Goals (SDGs) is dependent on the type of federalism that exists and its impacts on governance. This turns out to be considerably more significant because the promotion of the SDGs establishes an enabling business environment and attracts foreign investments by nurturing capital in its human, social, natural and physical forms. There is strong statistical evidence that suggests that the Indian state-wise SDG scores have a positive causality on the states’ Ease of Doing Business (EDB) index, and Foreign Direct Investments (FDI) flows to the Indian states. India’s SDG and EDB scores having grown consistently over the years — the SDG score has increased from 48.4 percent in 2016 to 61.9 percent in 2020, while the country depicted a tremendous jump in its EDB rankings from 130th to 63rd amongst 190 nations during the same period. While it is acknowledged that these indices are not ideal, there is still no doubt that it is strongly indicative of Indian trends in the years to come, in terms of conducive business environment and inflow of foreign capital.

Source: Author’s own; data from NITI Aayog and DPIIT, Ministry of Commerce and Industry, Government of India

III. ‘Superstar’ sectors

The pandemic has highlighted India’s potential in becoming a global manufacturing hub. With initiatives such as Make in India and Atmanirbhar Bharat, the government has managed to combine India’s competitive labour costs and robust IT skill-base with reliable power supplies and efficient transportation infrastructure. As a result, the Indian economy has succeeded in enhancing the nation’s production capabilities — ranging from the establishment of tech-driven value chains in smaller Indian cities to the production of masks and sanitisers by women-run Self Help Groups (SHGs).

India has been the world leader in ‘frugal and demand-driven innovation’ for a long time now. With cost reduction ranging from 50-90 percent and yet being quality-driven, India has already established itself as a giant in renewables and pharmaceuticals. Other superstar sectors with significant growth include automotives, electronic system and design, roads and highways, and food processing. As a result, India is now exhibiting trends of the nation’s export basket shifting from raw materials and agri products towards more complex goods, with a higher knowledge quotient — as has been the trend for the advanced economies in the past.

"With cost reduction ranging from 50-90 percent and yet being quality-driven, India has already established itself as a giant in renewables and pharmaceuticals."

IV. Foreign investments

Over the past few years, there has been considerable discussion about how India can attract firms that might be looking to exit China. At first, these conversations were inspired by shifts in the Chinese economy, like rising labour costs and declining productivity. But now, with several developed economies like the US, Germany and Japan looking to dilute their economic dependence on China due to the pandemic-induced supply chain disruptions and the US-China trade war, this is a rare opportunity for India to draw FDI en masse.

Therefore, to maximise FDI, the centre has initiated multiple policy interventions, such as allowing 100 percent FDI in contract manufacturing under automatic route, consolidating wage laws into the Four Labour Codes, setting up a land pool of 461,589 hectares for foreign companies and slashing corporate tax rates to 15 percent for new manufacturing companies. As a result, several firms like Apple, Harley Davidson, Skechers and Von Wellx have decided to relocate their production to India from China, amidst the pandemic.

V. Sub-regionalism

Despite the significant economic and political disruptions, the Indian economy has grown six times in the last two decades — from a nominal GDP of less than half a trillion US$ to about US$ 2.7 trillion. Additionally, India possesses one of the most fundamentally strong input and output markets in the world. And with the biggest human resources base across different degrees of expertise, this is the market that the world will seek access to in the near future.

Therefore, India’s scepticism towards China’s Belt and Road Initiative (BRI) is one such strong indicator that the country now wants to fiercely protect both its market-base and territorial sovereignty. Consequently, India has been realigning itself towards sub-regional groupings like ASEAN and the BIMSTEC with the goal to improve physical connectivity and facilitate regional trade partnerships.

The author acknowledges Kulseen Singh at NLSIU Bengaluru for his research inputs on this article.

Soumya Bhowmick (ORF)

30 March 2021

Comments :

- No comments

Post a comment